Support Our Youth Financial Literacy Initiative

Empower the Next Generation of Financial Leaders!

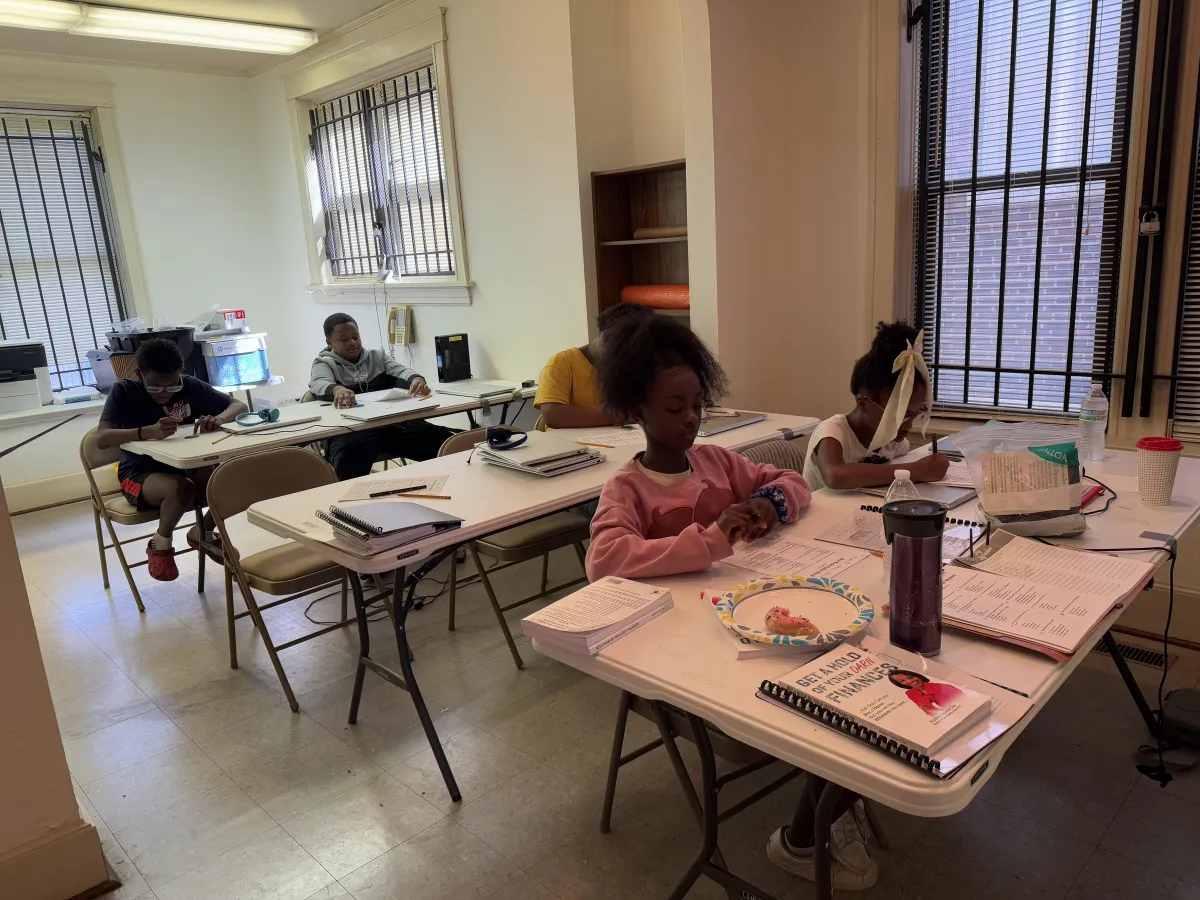

At Transformational Education Services, Inc., in collaboration with the College Hill Foundation Golf Program, we are providing young people with the financial literacy skills they need to succeed in life.

By sponsoring a child in our Get A Hold Of Your Darn Finances (GAHOYDF) program, you are directly contributing to their education and future. Our program teaches budgeting, saving, and investing, setting these students up for long-term financial success.

Your support will help us open a bank account for each child upon completion, allowing them to practice managing their money responsibly from an early age. You are helping these kids develop the tools they need to make smart financial decisions, avoid debt, and build a foundation for a prosperous future.

Together, with the College Hill Foundation Golf Program, we are making a lasting difference in their lives by providing them with the resources to thrive financially and succeed in the world.

Bank Accounts

$1750.00 Donation Will

Go A Long Way

We are seeking sponsors to help fund the financial literacy education of 7 deserving students in the GAHOYDF program. Your contribution of $250 per child will be used to open a bank account in their name upon completing the program.

All students are required to follow our program rules, which include maintaining proper conduct, attending every session, actively participating in activities, and completing all assignments. To qualify for the bank account opening, students must meet these expectations. To motivate consistent engagement, each child will receive $25 per week for classroom participation, provided they fulfill these requirements.

This comprehensive course covers essential financial skills such as budgeting, saving, investing, and credit management. By sponsoring a child, you're not only supporting their education but also helping them develop the habits and skills needed to become financially responsible and confident in their decision-making. Your support will empower them to manage their money, build savings, and make informed financial decisions that will positively impact their future.

What’s Included in the Program:

Comprehensive Financial Literacy Course: The course covers important topics like budgeting, saving, investing, and credit management, giving each child a solid foundation in how to manage money.

Budgeting Basics: Students learn how to create a budget, track their spending, and understand how their money choices affect their future goals.

Saving and Goal Setting: The program teaches kids how to save money for both short-term needs and long-term goals, such as building an emergency fund or saving for big purchases.

Introduction to Investing: We introduce the basics of investing, showing kids how to grow their money over time and explaining different types of investments.

Credit Management: Students learn about credit scores, how credit works, and how to use it responsibly to avoid debt and ensure financial stability.

Bank Account Setup: After completing the course, the funds raised will be used to open a real bank account for each child, providing them with the opportunity to practice managing their own money.

Practical Money Skills: The program focuses on real-life money skills, teaching kids how to make smart decisions, manage money well, and understand the consequences of poor financial choices.

Quizzes and Weekly Tests: To ensure understanding, students will take weekly quizzes through Kahoot in fun, interactive game formats. These games make learning engaging and help reinforce key financial concepts, ensuring they’re ready to apply their knowledge in real life.time.

What others are saying

"Loved everything so far"

Taking the class helped me understand the importance of Money and how hard she will work for you if you follow her rules.

- Sophia

"My life changed forever"

I learned a lot from each sister and how they taught you about Money. I like their outfits and shoes too! lol

- Anissa

"Highly recommend this"

This course taught me important things about Money. I don't look and treat her the same as I did before.

- Aden

© 2025 Transformational Education Services Inc. - All Rights Reserved - Privacy Policy Terms Of Use